The High Cost of Bad Credit: What You’re Really Paying

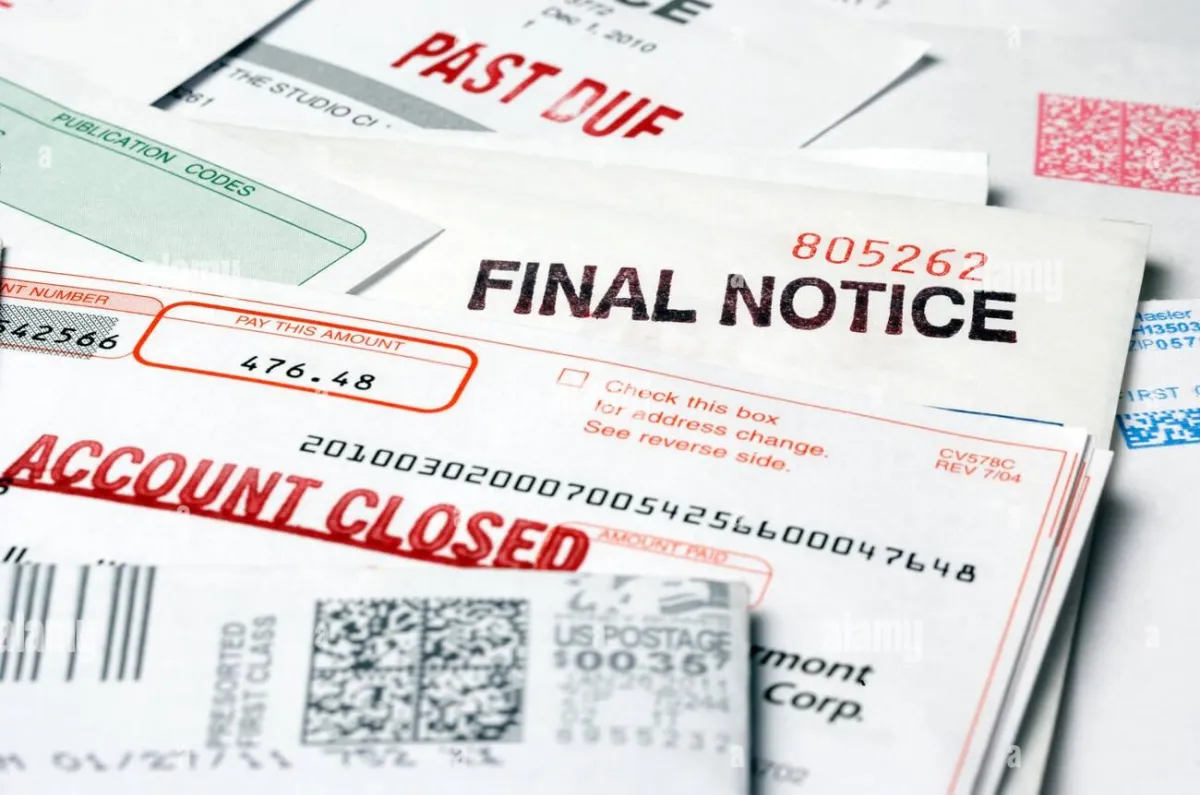

Bad credit is more than just an inconvenience—it’s a financial burden that can cost you thousands of dollars over your lifetime. From higher interest rates to limited financial opportunities, the repercussions of a low credit score can be far-reaching and expensive. In this blog, we’ll break down the true cost of bad credit and why improving your credit score should be a top priority.

Higher Interest Rates

One of the most immediate and impactful ways bad credit affects your finances is through higher interest rates on loans and credit cards.

Mortgages: A lower credit score can result in a significantly higher mortgage interest rate. For example, on a $200,000 30-year mortgage, a 1% difference in interest rate could cost you an extra $50,000 or more over the life of the loan.

Auto Loans: Bad credit can also lead to much higher interest rates on car loans. You might end up paying thousands more for the same car compared to someone with good credit.

Credit Cards: Those with bad credit often face higher APRs (Annual Percentage Rates) on credit cards, making it more expensive to carry a balance from month to month. Additionally, you may only qualify for secured credit cards, which require a deposit, further limiting your financial flexibility.

Higher Insurance Premiums

Insurance companies often use credit scores to determine premiums for auto and home insurance.

Auto Insurance: A poor credit score can lead to higher auto insurance premiums. Insurance companies believe that individuals with lower credit scores are more likely to file claims, so they charge higher rates to offset this perceived risk. The difference in premiums between someone with excellent credit and someone with poor credit can be hundreds of dollars annually.

Homeowners Insurance: Similarly, homeowners with bad credit may face higher insurance costs. Over time, these increased premiums can add up, making homeownership even more expensive.

Limited Access to Financial Products

Bad credit doesn’t just cost you more; it can also limit your access to financial products and opportunities.

Denied Loan Applications: With bad credit, you’re more likely to be denied when applying for loans, whether for a mortgage, car, or personal loan. This can force you to rely on less favorable options like payday loans or high-interest personal loans, which can trap you in a cycle of debt.

Limited Credit Card Options: Many credit cards with the best rewards, low interest rates, and other perks are only available to those with good to excellent credit. If you have bad credit, you may be stuck with high-fee, low-reward options that don’t serve your financial goals.

Higher Deposits and Fees

Having bad credit can also lead to higher deposits and fees in everyday situations.

Utilities and Rental Agreements: Utility companies and landlords often require higher security deposits from individuals with bad credit. This can add hundreds of dollars in upfront costs when moving into a new home or setting up services.

Cell Phone Plans: If your credit score is low, you may need to pay a deposit for a cell phone plan, or you might only qualify for a prepaid plan, which can be more expensive and offer fewer benefits than traditional plans.

Missed Opportunities

Beyond the direct financial costs, bad credit can also cost you opportunities that are harder to quantify but equally important.

Employment: As mentioned earlier, some employers check credit as part of their hiring process. A poor credit history might not directly disqualify you, but it could be a deciding factor in a competitive job market, especially for positions involving financial responsibility.

Housing Options: Bad credit can limit your choices when renting an apartment or buying a home. Landlords may reject your application, and mortgage lenders may deny you the best rates, restricting your options for where you can live.

Conclusion

Bad credit is a costly burden that can affect every aspect of your financial life. The higher interest rates, increased insurance premiums, limited access to financial products, and missed opportunities add up over time, often costing far more than we realize. The good news is that bad credit doesn’t have to be permanent. By taking steps to improve your credit score—such as paying bills on time, reducing debt, and regularly checking your credit report—you can mitigate these costs and regain control over your financial future.